Cycles, Currency, and Change: How Four Visionary Books Predicted Our Time

In the vast, often bewildering tapestry of human history, where events seem as unpredictable as the weather on a planet where the sun refuses to set, a few thinkers have dared to predict the storms before they brew. Four books, each penned by a modern-day soothsayer, have laid out frameworks that eerily mirror the current global scenario, offering not just a narrative of our times but a roadmap for what lies ahead. Let's embark on a journey through the visionary predictions of William Strauss and Neil Howe's "The Fourth Turning," Lyn Alden's "Broken Money," Jeff Booth's "The Price of Tomorrow," and Ray Dalio's "The Changing World Order.

The Fourth Turning: The Cycle of Crisis

Strauss and Howe's "The Fourth Turning" introduces the theory of generational cycles, where history unfolds in predictable, repeating patterns. Their work, published in the late '90s, posited that America (and indeed much of the Western world) was entering what they termed the "Fourth Turning" – a period of crisis.

Predictions for Today: The books foresaw a time of upheaval where society would face a significant challenge, possibly a war, an economic collapse, or a profound cultural shift. Here we are, amidst a global health crisis, economic instability, and a rising sense of political and social fragmentation. The generational conflict, with Millennials and Gen Z pushing back against the established norms, aligns with their prediction of an Awakening phase escalating into a Crisis.

Future Forecast: According to this cycle, we are in the throes of this crisis, which will culminate in a new order. Post-crisis, there would be a "High" – a period of rebuilding and unity. However, the specifics of what this new order might look like are left tantalizingly vague, much like predicting the flavor of the soup humanity will cook up with the ingredients left after the storm.

For example,

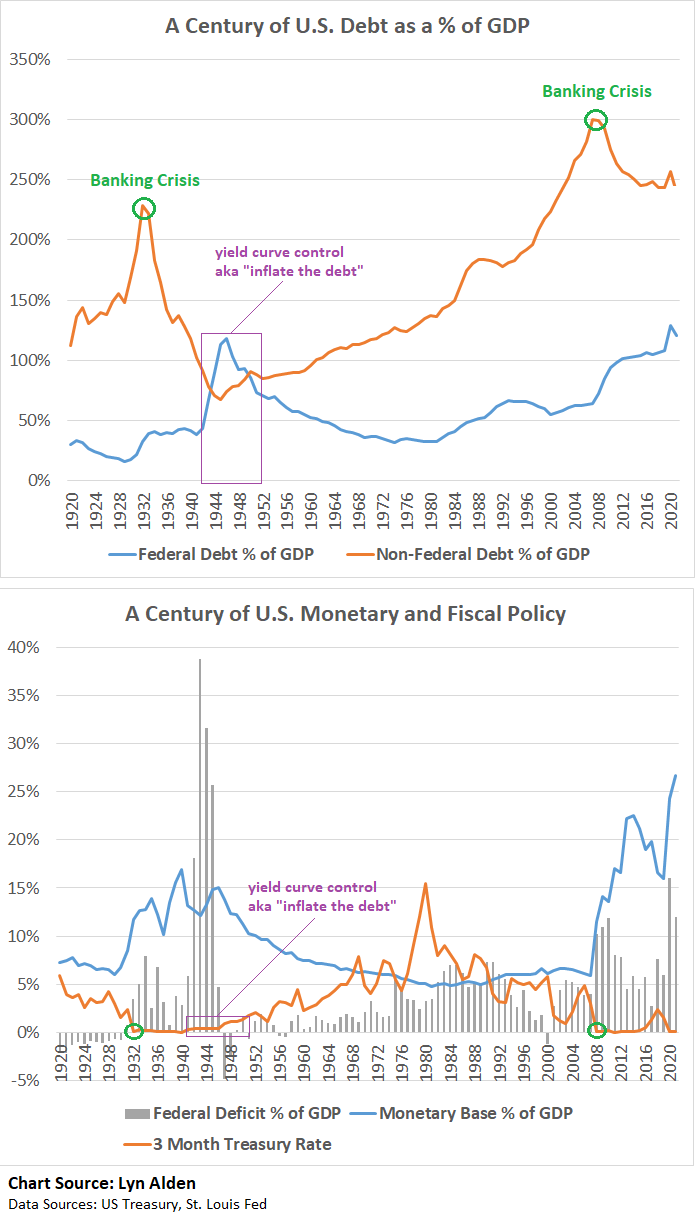

The prior fourth turning was the 1930s/1940s. The current one is 2010s/2020s (roughly). Various macro shifts, monetary system resets, and so forth are there. No wonder existing institutions break down. Quantifying things is helpful.

Broken Money: The Economic Underpinnings

Lyn Alden's "Broken Money" dives into the intricate dance of modern economics, focusing on how technology and debt have distorted monetary systems.

Predictions for Today: Alden warned of the consequences of unsustainable debt levels and the artificial inflation of asset prices, predicting a potential reckoning for economies reliant on ever-increasing debt. Today, we see this in the global debt crisis, the volatility in stock markets, and the general unease about the sustainability of our economic systems.

Future Forecast: The future, as per Alden, involves a re-evaluation of what money is, potentially leading to a new monetary standard, whether that be cryptocurrency, a return to commodity-based systems like gold, or something entirely unforeseen. Her vision includes a world where economic policies must adapt to technological deflation, suggesting a future where efficiency gains from technology could lead to deflationary pressures, challenging central banks' traditional roles.

The Price of Tomorrow: Embracing Deflation

Jeff Booth, in "The Price of Tomorrow," argues that technology inherently drives prices towards zero, advocating for an embrace of deflation as a path to abundance.

Predictions for Today: Booth's book predicted the rise of automation and AI, leading to widespread job displacement due to technological advances. We're witnessing this with automation in industries and the gig economy's expansion, where traditional jobs are being replaced by more efficient, often digital, alternatives.

Future Forecast: Booth sees a future where, if we can manage the transition, we could live in an era of abundance with lower costs due to technology. However, this requires a seismic shift in how we view work, wealth, and economic policy. The challenge lies in navigating this transition without exacerbating inequality, which could lead to social unrest if not managed with foresight and equity.

The Changing World Order: The Rise and Fall of Empires

Ray Dalio's "The Changing World Order" takes a macroscopic view, examining the rise and decline of empires through economic, political, and social lenses.

Predictions for Today: Dalio highlighted the potential decline of the U.S. as a global superpower due to factors like debt, internal conflict, and the rise of China. His analysis seems prescient as we observe the U.S. grappling with its domestic issues, China's increasing assertiveness on the global stage, and the strategic maneuvers in international relations reflecting a shift in global power dynamics.

Future Forecast: Dalio's framework suggests we might see a period of great power rivalry, potentially leading to conflicts or a redefinition of the world order. He posits that nations will need to adapt or face decline, advocating for a deep understanding of these cycles to navigate future challenges effectively. His view on money as a tool that can either build or break nations underscores the need for financial prudence and innovation in monetary policies.

Synthesis: The Interwoven Predictions

When we weave these predictions together, a complex but coherent picture emerges:

Immediate Future: We are likely in a phase where economic, technological, and generational forces are colliding, creating both crises and opportunities. This convergence could lead to a period of significant global restructuring, where old systems are challenged, and new ones are born amidst chaos.

Long-term Vision: The long-term future might see a decentralization of power, not just in governance but in how we think about wealth and work. The embrace of technology could lead to a society where the scarcity mindset gives way to abundance, provided we manage the transition ethically and equitably.

Adaptation and Resilience: The key theme from all these works is adaptation. Societies that can adapt to technological deflation, generational shifts, and changing global dynamics will thrive. Those that cling to outdated models might find themselves at a disadvantage.

In conclusion, these authors have not just predicted the current world events but have provided a lens through which we can view the future. Their works remind us that while history might not repeat, it often rhymes. Humanity, with its penchant for drama and unpredictability, continues to follow these rhythms, sometimes dancing gracefully, other times stumbling. But as any good guide would say, "Don't Panic." The future, while uncertain, offers a chance for renewal and innovation, provided we're willing to read the signs and adjust our sails accordingly.